8 Free Financial Literacy Activities for Youth

by Julia McDonald on 16 Nov, 2021

At ChatterHigh, we love talking about career exploration. The whole process of self-discovery and learning about job opportunities is exciting and vital to student engagement. However, setting students up for future success requires more than just career exploration. Without financial know-how, students may be ill-prepared to make informed decisions with regard to budgeting, loans, saving, investments, and more. And that’s problematic.

TL;DR

Research shows us that there's a need to educate young Canadians on basic financial activities. So here's a list of several free and fun resources your students can use at home or in class to prepare for their financial future!

- Online activities. Introduce students to concepts like budgeting, credit, saving, insurance, and more through games and courses.

- Printable activities. Looking for lesson plans and activity pages? Look no further! Discover materials for students of all grades.

Research

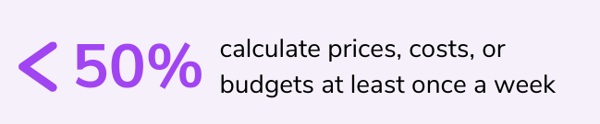

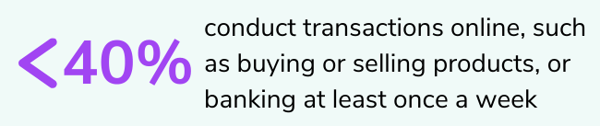

According to data published by the OECD on how frequently Canadian youth complete financial activities in their everyday life:

These are some pretty basic and fundamental financial activities. For example, budgeting is a simple and effective way to avoid spending money you don’t have, which can be especially helpful for students who are living independently for the first time. Yet, we see that Canadian youth aren’t very familiar with these practices. But that’s not all. Research also shows that there is a gender gap.

In fact, the PISA 2018 assessment discovered that when accounting for performance in mathematics and reading, the gender gap for financial literacy “was significant and in favour of boys in 13 of the 19 participating countries/economies.” This study also found that when it came to using digital financial services like paying with a debit card, keeping track of their balance, or transferring money, boys were more confident than girls. In addition to finding a gender gap, the research also discovered a significant gap regarding socioeconomic status. Specifically, “advantaged students scored 78 score points, or roughly one proficiency level, higher than disadvantaged students.”

So where do we go from here? Well, we went to the web to find some fantastic financial literacy activities you can do with students to improve their financial confidence and capabilities (and it won’t cost you a dime). To ensure no student is left behind, we found some free online games and printable material that all students can access and enjoy.

Free Online Financial Literacy Activities

1. Money Magic

“Money Magic” is all about budgeting. In this online game, students become the manager of Enzo, a magician who aspires to perform in Vegas. In each round, students have to allocate money from a limited budget towards different categories. The choices students make directly impact how much Enzo earns from a show, as well as meters, such as the “morale meter,” on the side of the screen. Students must learn to optimize their limited resources, as well as respond to unexpected costs, to maximize Enzo’s performance and therefore his profit.

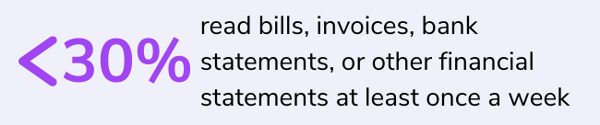

2. Lights, Camera, Budget!

If your students aren’t interested in planning a magic show, perhaps they’d like to produce a movie with a $100 million budget. While the title mentions budgeting, “Lights, Camera, Budget!” introduces students to other financial concepts, such as credit, saving, and insurance. Since students earn money for answering finance-oriented quiz questions correctly, the success of their movie depends on their financial know-how. This game also has the added benefit of offering one version for middle school students and one for high school students.

3. Shady Sam

In this game, students are employed by loan shark Shady Sam. As Sam’s employees, they are tasked with getting as much money as possible from clients. Every time a client asks for a loan, three options appear, each listing the monthly payment amount (including interest), the interest rate, and the length of the loan. It’s up to students to choose the loan option that will make their shady boss the most money. This role-reversal game helps students understand some of the ins and outs of debt. In particular, it teaches them that the lowest monthly payment isn’t always the best option.

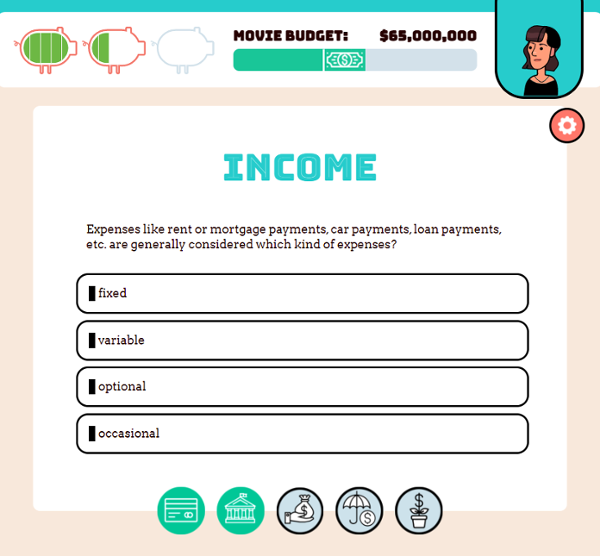

4. ChatterHigh

ChatterHigh’s proven “research and learn” approach is a great way to engage students in financial literacy activities. The gamified design of our platform, not to mention the ability to earn points to win prizes or donate to charity, motivates students to dive into the material. Speaking of material, we recently partnered with the Financial Consumer Agency of Canada to offer two courses all about financial literacy for students all across North America. Want to check out the course content? You can download the question booklets by clicking here.

Want to join us in preparing students for their future through financial literacy education? Check out our Partners page.

The Empowering Futures: Boosting Girls’ Financial Confidence Through Gamified Learning research brief by the Financial Consumer Agency of Canada (FCAC) highlights the impact of gamified financial education on closing the gender gap in financial literacy. Through the partnership with ChatterHigh, over 7,400 students in grades 6-12 across Canada engaged in gamified financial literacy courses: Money Management Foundations and Managing My Money After High School. The results showed significant improvements in financial knowledge and confidence for both girls and boys, with girls experiencing notable gains in areas like credit card knowledge, awareness of future expenses, and financial preparedness. This research demonstrates how gamified learning can foster financial resilience and confidence, especially for girls, helping them step into adulthood with the skills needed to navigate real-world financial challenges.

5. JA Campus

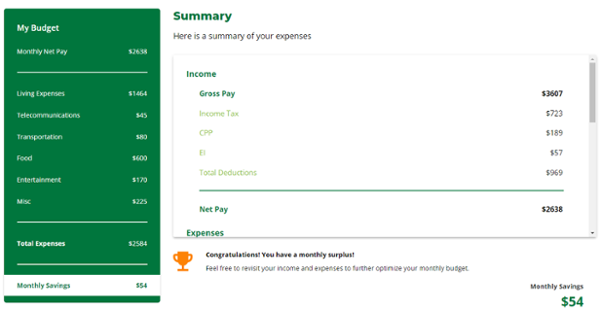

JA Canada is the country’s largest youth business education organization. They offer a variety of resources for students, teachers, and parents, including some fantastic online courses through their free, virtual learning space called JA Campus. While they have teacher-led courses, which you can check out here, their self-directed programs are a great way to get students engaged in financial literacy activities at home or in the classroom. Courses such as Personal Finance and Economics for Success are particularly helpful in promoting financial literacy in students, as they cover topics such as paycheques, taxes, budgeting, and credit.

Free Printable Financial Literacy Activities

6. Money Mentors: Teacher Resources & Classroom Activities

Money Mentors is an Alberta-based non-profit financial counselling and education agency, and they want to provide you with free financial literacy activities for your students! In fact, they have at least two free worksheets or activities for each grade level, plus additional worksheets. Covering topics such as fixed vs. variable expenses, debt vs. assets, how to read a pay stub, and opportunity cost, the material helps show students the relevance of financial literacy in their everyday lives.

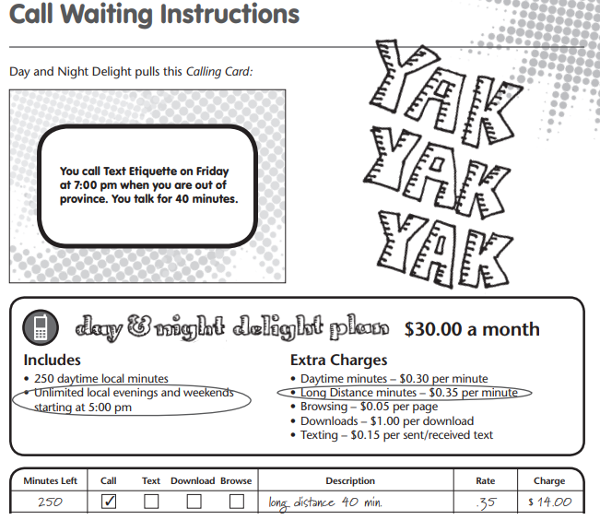

7. Make it Count: An Instructor’s Guide to Youth Money Management

The Credit Counselling Society partnered with the Surrey (BC) School District to offer you a downloadable PDF filled with 17 lesson plans, complete with games and worksheets for your students. Designed for students in grades 4 to 7, the lessons fall into four categories: Back to basics, Out and about, Lessons for life and Fun with friends. This PDF is packed with fun worksheets that will get your students making budgets for vacations and parties, assessing types of banking accounts, and calculating the cost of their entertainment.

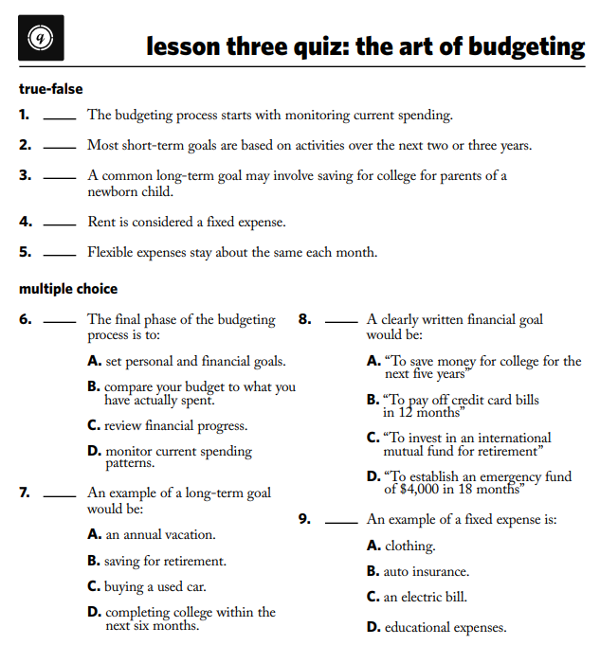

8. InCharge: Financial Literacy Lesson Plans for High School Teachers

InCharge is a company offering debt solutions and on their website, they have an entire page dedicated to high school teacher resources! This page includes resources for 14 different lesson plans, complete with worksheets, teaching notes, and PowerPoint presentations. Here are just a few of the great topics you’ll find covered:

- Budgeting

- Buying a Home

- Credit

- The Influence of Advertising

- Consumer Privacy

Conclusion

At ChatterHigh, we want students to be prepared for their future, including their financial future. That's why we made this list of resources. That, and to help you. We are here for students and educators, for the entire school community. And we'd love to hear your feedback. Have ideas about subjects that should be covered in a financial literacy course? Send us an email! Know of another free (and fun) financial literacy resource that educators would love? Drop us a note via the contact page and we’ll add it to our roundup!

-1.png?width=600&name=Blog%20CTA%20(2)-1.png)